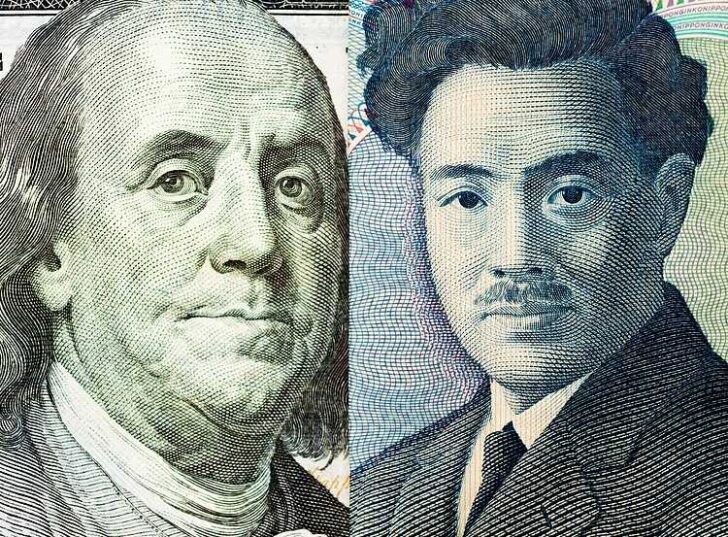

Most Asian currencies moved in a flat-to-low range on Monday, and were nursing steep losses from the past week as concerns over higher-for-longer interest rates kept traders largely biased towards the dollar.

Still, easing fears over a bigger conflict in the Middle East offered regional currencies some relief, as risk appetite improved.

But most regional units still retained a bulk of their losses from over the past week, as traders steadily priced out expectations that the Federal Reserve will cut interest rates by as soon as June.

Dollar steady, more rate cues awaited this week

The dollar index and dollar index futures both fell slightly in Asian trade on Monday, but remained close to over five-month highs hit earlier in April.

Waning bets on a June rate cut boosted the dollar, especially after strong U.S. inflation readings and hawkish commentary from top Fed officials.

Focus this week is on more cues on U.S. monetary policy, specifically from PCE price index data- which is the Fed’s preferred inflation gauge. The reading is due on Friday and is expected to reiterate that U.S. inflation remained sticky in March.

More cues on the U.S. economy are also due this week, with purchasing managers index data for April set to offer more insight into business activity.

Chinese yuan steady after PBOC holds loan prime rate

The Chinese yuan’s USDCNY pair moved little on Monday after the People’s Bank of China kept its benchmark loan prime rate on hold, as expected.

The LPR was kept at record lows, as the PBOC moved to keep monetary policy as loose as possible to buoy economic growth. The central bank is also expected to further trim the rate this year, after a cut to the five-year LPR in February.

But low interest rates are also expected to keep the yuan under pressure. The USDCNY pair was close to a five-month high, above the psychologically important 7.2 level.

Japanese yen flat, BOJ meeting awaited

The Japanese yen’s USDJPY pair moved little on Monday, but remained well above the 154 level amid little relief from the dollar.

This kept investors on guard over any potential government intervention, especially as the USDJPY pair tested 34-year highs at 155.

Focus this week is on a Bank of Japan rate decision on Friday- the central bank’s first meeting after a historic rate hike in March. Any cues on future rate hikes and policy changes will be closely watched.

Broader Asian currencies moved little as fears of higher-for-longer U.S. rates remained in play.

The Australian dollar’s AUDUSD pair rose 0.3% after tumbling to a five-month low last week.

The South Korean won’s USDKRW pair rose 0.5%, while the Singapore dollar’s USDSGD pair was flat.

The Indian rupee’s USDINR pair rose 0.1%, but was trading below record highs hit last week.

Leave a Reply