- The Japanese Yen witnessed a dramatic intraday turnaround from a nearly 40-year low on Monday.

- A possible intervention by Japanese authorities seems to be a possible reason behind a sharp recovery.

- The divergent BoJ-Fed monetary policy and a positive risk tone should cap further gains for the JPY.

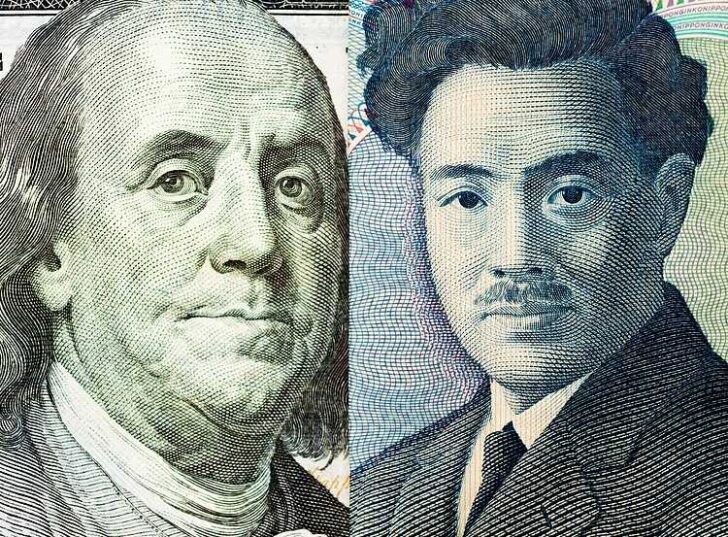

The Japanese Yen (JPY) staged a solid intraday recovery from its lowest level since October 1986 touched against its American counterpart during the Asian session on Monday and rallies around 500 pips from levels below the 160.00 psychological mark. The sharp intraday bounce could be attributed to some intervention by Japanese authorities to bolster the domestic currency, though no official announcement has been made so far. This, along with a modest US Dollar (USD) downtick, contributes to the USD/JPY pair’s sharp downfall witnessed over the past hour or so.

Any meaningful JPY-appreciating move, however, still seems elusive in the wake of the Bank of Japan’s (BoJ) cautious approach towards further policy tightening and the uncertain rate outlook. In contrast, the Federal Reserve (Fed) is expected to delay cutting interest rates in the wake of still sticky inflation, bolstered by Friday’s release of the Personal Consumption Expenditures (PCE) Price Index. This, in turn, suggests that the wide gap in interest rates between the US and Japan will remain for some time, which, along with a generally positive risk tone, should cap the JPY.

Daily Digest Market Movers: Japanese Yen surges amid reports of a possible intervention by Japanese authorities

- The Japanese Yen rebounds swiftly after an initial slump to a nearly 40-year low against its American counterpart on Monday amid a possible intervention by Japanese authorities to support the domestic currency.

- That said, a big divergence in the Bank of Japan’s policy outlook and hawkish Federal Reserve expectations, along with a positive risk tone, should keep a lid on any further appreciating move for the safe-haven JPY.

- As was widely anticipated, the BoJ left its short-term interest rates unchanged on Friday and indicated that inflation was on track to hit the 2% target in coming years, suggesting its readiness to hike borrowing costs later this year.

- In the post-meeting press conference, BoJ Governor Kazuo Ueda offered few clues on when the next rate hike will come and ruled out shifting to a full-fledged reduction in the bond purchases, warranting caution for the JPY bulls.

- Moreover, the Tokyo Consumer Price Index released on Friday indicated that inflation in Japan is cooling, which, along with a generally positive tone around the equity markets, should cap any meaningful upside for the safe-haven JPY.

- Japan’s ruling Liberal Democratic Party lost three key by-election seats, which is not seen as a vote of confidence in Prime Minister Fumio Kishida and argued against him being reappointed at the end of the term in September.

- The US Bureau of Economic Analysis reported that the Personal Consumption Expenditures (PCE) Price Index rose 0.3% in March, while the yearly rate climbed to 2.7% from 2.5% in February, beating estimates for a reading of 2.6%.

- Adding to this, the core PCE Price Index, which excludes volatile food and energy prices, held steady at the 2.8% YoY rate as compared to 2.6% anticipated, reaffirming bets that the Federal Reserve will keep rates higher for longer.

- According to the CME Group’s FedWatch tool, investors are now pricing in a 58% chance that the Fed will begin its rate-cutting cycle in September, down from 68% a week ago, and a more than 80% possibility of easing in December.

- This suggests that the wide gap in rates between Japan and the United States will remain for some time, which, along with a positive risk tone, should cap the upside for the safe-haven JPY and lend support to the USD/JPY pair.

- Investors now look forward to this week’s key central bank event risk – a two-day FOMC monetary policy meeting starting on Tuesday and the closely-watched US Nonfarm Payrolls (NFP) report – for a fresh directional impetus.

Technical Analysis: USD/JPY bulls turn cautious amid extremely overbought RSI on the daily chart

From a technical perspective, Friday’s breakout through an upward-sloping trend channel extending from the YTD low was seen as a fresh trigger for bullish traders. That said, the Relative Strength Index (RSI) on the daily chart is flashing extremely overbought conditions, which prompts aggressive long-unwinding trade on the first day of a new week. Any subsequent slide, however, is likely to find decent support near the 157.00 mark, representing the ascending channel resistance breakpoint. The latter should act as a key pivotal point, which if broken decisively might shift the near-term bias in favour of bearish traders and pave the way for some meaningful corrective decline.

Leave a Reply