- The Japanese Yen continues to draw support from speculated government intervention.

- The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair.

- Investors now look forward to the crucial US NFP report for a fresh directional impetus.

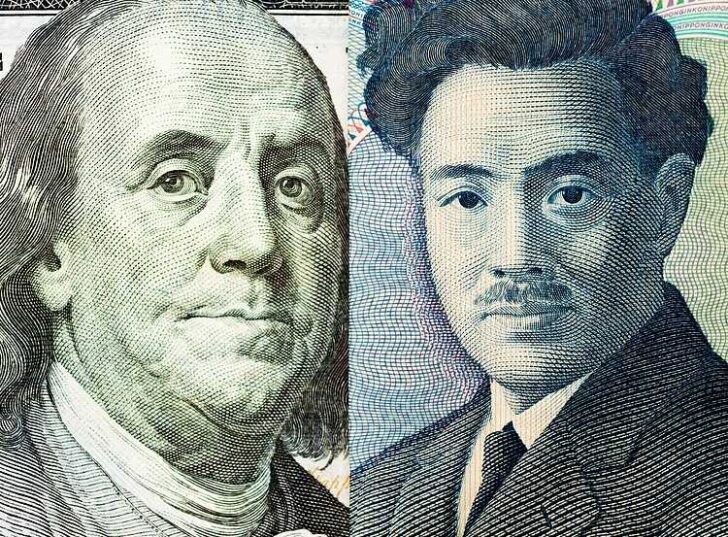

The Japanese Yen (JPY) attracts buyers for the third successive day on Friday, or the fourth day in the previous five, and climbs to a nearly three-week high against its American counterpart during the Asian session. Speculations that Japan’s financial authorities intervened again on Thursday, for the second time this week, with an intention to prop up the domestic currency, turn out to be a key factor lending support to the JPY. The US Dollar (USD), on the other hand, adds to its post-FOMC losses and further contributes to the offered tone surrounding the USD/JPY pair.

It, however, remains to be seen if the JPY bulls are able to retain their dominant position in the wake of growing acceptance that the US-Japan interest rate differential will remain wide for some time. Furthermore, a generally positive tone around the equity markets could act as a headwind for the safe-haven JPY and help limit the downside for the USD/JPY pair. Traders might also refrain from placing aggressive directional bets and prefer to wait on the sidelines ahead of the release of the crucial US jobs data – popularly known as the Nonfarm Payrolls (NFP) report later today.

Daily Digest Market Movers: Japanese Yen remains on the front foot in the wake of alleged intervention by authorities

- Bank of Japan data showed on Thursday that Japanese officials may have spent around ¥3.66 trillion on Wednesday to boost the domestic currency, lending support to the Japanese Yen.

- Japan’s top currency diplomat, Masato Kanda, declined to directly confirm that intervention had occurred and said that the Ministry of Finance will disclose data at the end of this month.

- The Federal Reserve dismissed the prospects for any further interest rate hikes despite sticky inflation, which continues to weigh on the US Dollar and exerts pressure on the USD/JPY pair.

- Meanwhile, Fed Chair Jerome Powell flagged no intention to cut interest rates in the near term, citing the lack of progress in the fight to bring inflation back to the central bank’s 2% target.

- In contrast, the BoJ has indicated that accommodative financial conditions will be maintained for an extended period, which, in turn, might hold back the JPY bulls from placing aggressive bets.

- Japan’s finance minister, Shunichi Suzuki, and BoJ Governor Kazuo Ueda will hold a press conference on the sidelines of the ADB meeting at 13:45 GMT, which should provide some impetus.

- Later, during the North American session, the release of the US jobs data, or the Nonfarm Payrolls (NFP) report, will influence the USD and determine the near-term trajectory for the USD/JPY pair.

Technical Analysis: USD/JPY seems vulnerable to test 152.00 confluence, 50% Fibo. level support breakdown in play

From a technical perspective, a break below the 50% Fibonacci retracement level of the March-April rally might have already set the stage for deeper losses. The outlook is reinforced by the fact that oscillators on the daily chart have just started gaining negative traction. This, in turn, suggests a subsequent fall toward testing the 152.00 confluence, comprising the 50-day Simple Moving Average (SMA) and the 61.8% Fibo. level, looks like a distinct possibility. The said handle also marks a previous strong resistance breakpoint, but it has now turned support. Hence, a convincing break below will be seen as a fresh trigger for bearish trades and pave the way for an extension of the recent sharp pullback from the all-time peak touched in April.

On the flip side, any recovery back above the 153.00 mark now seems to confront some resistance near the 153.50 area ahead of the Asian session peak, around the 153.75 region. This is followed by the 154.00 round figure, which if cleared decisively, might trigger a short-covering rally. The subsequent move-up should allow the USD/JPY pair to reclaim the 155.00 psychological mark, with some intermediate resistance near the 154.45-154.50 zone.

Leave a Reply